In ages past, gold and silver provided humanity with a system of economic co-operation among productive humans, which was fair to all participants.

With gold and silver, humans were trading value-for-value: what changed hands were amounts of physical gold or silver, or at least, Bills which were unquestioned claims upon gold or silver.

When the exchange had taken place, everyone was happy! The seller because he had gold or silver, in exchange for the goods or services he offered; and the buyer was pleased because he had the goods or services he wanted, and he got them by tendering gold or silver in exchange.

So, everyone was pleased: the buyer because he got the goods or services he wanted, in exchange for his gold or silver; and the seller was pleased because he traded the goods or services he had to offer, tor gold or silver.

Under the present monetary system, there can be no justice or “fair trading”, because all the World’s MONEY IS FAKE MONEY.

info from

https://en.wikipedia.org/wiki/World_currency

Single world currency[edit]

See also: Geary–Khamis dollar

An alternative definition of a world or global currency refers to a hypothetical single global currency or supercurrency, as the proposed terra or the DEY (acronym for Dollar Euro Yen),[15] produced and supported by a central bank which is used for all transactions around the world, regardless of the nationality of the entities (individuals, corporations, governments, or other organizations) involved in the transaction. No such official currency currently exists.

Advocates, notably Keynes,[16] of a global currency often argue that such a currency would not suffer from inflation, which, in extreme cases, has had disastrous effects for economies. In addition, many[16] argue that a single global currency would make conducting international business more efficient and would encourage foreign direct investment (FDI).

There are many different variations of the idea, including a possibility that it would be administered by a global central bank that would define its own monetary standard or that it would be on the gold standard.[17] Supporters often point to the euro as an example of a supranational currency successfully[dubious – discuss] implemented by a union of nations with disparate languages, cultures, and economies.

A limited alternative would be a world reserve currency issued by the International Monetary Fund, as an evolution of the existing special drawing rights and used as reserve assets by all national and regional central banks. On 26 March 2009, a UN panel of expert economists called for a new global currency reserve scheme to replace the current US dollar-based system. The panel’s report pointed out that the “greatly expanded SDR (special drawing rights), with regular or cyclically adjusted emissions calibrated to the size of reserve accumulations, could contribute to global stability, economic strength and global equity.”[18]

Another world currency was proposed to use conceptual currency to aid the transaction between countries. The basic idea is to utilize the balance of trade to cancel out the currency actually needed to trade.

In addition to the idea of a single world currency, some evidence suggests the world may evolve multiple global currencies that exchange on a singular market system. The rise of digital global currencies owned by privately held companies or groups such as Ven[19] suggest that multiple global currencies may offer wider formats for trade as they gain strength and wider acceptance.

WOCU currency, based on the WOCU synthetic global currency quotation derived from a weighted basket of currencies of fiat currency pairs covering the top 20 economies of the world, is planned to be issued and distributed [20] by Unite Global[21] a centralised platform for global real-time payments and settlement.

Bitcoin[edit]

Bitcoin offers the possibility that a decentralized system that works with little human intervention could eliminate squabbling over who would administer the world central bank.[22]

Difficulties[edit]

Limited additional benefit with extra cost[edit]

Some economists argue that a single world currency is unnecessary, because the U.S. dollar is providing many of the benefits of a world currency while avoiding some of the costs [23]However, this de facto situation gives the U.S. government additional power over other countries (see for example the Iraq war when Iraq wanted to switch to the Euro for oil pricing). If the world does not form an optimum currency area, then it would be economically inefficient for the world to share one currency.

Economically incompatible nations[edit]

In the present world, nations are not able to work together closely enough to be able to produce and support a common currency. There has to be a high level of trust between different countries before a true world currency could be created. A world currency might even undermine national sovereignty of smaller states.

Wealth redistribution[edit]

The interest rate set by the central bank indirectly determines the interest rate customers must pay on their bank loans. This interest rate affects the rate of interest among individuals, investments, and countries. Lending to the poor involves more risk than lending to the rich. As a result of the larger differences in wealth in different areas of the world, a central bank’s ability to set interest rate to make the area prosper will be increasingly compromised, since it places wealthiest regions in conflict with the poorest regions in debt.

Usury[edit]

Usury – the accumulation of interest on loan principal – is prohibited by the texts of some major religions. In Christianity and Judaism, adherents are forbidden to charge interest to other adherents or to the poor (Leviticus 25:35–38; Deuteronomy 23:19). Islam forbids usury, known in Arabic as riba.[24]

Some religious adherents who oppose the paying of interest are currently able to use banking facilities in their countries which regulate interest. An example of this is the Islamic banking system, which is characterized by a nation’s central bank setting interest rates for most other transactions.[citation needed]

the power to create infinite sums of currency devalues the fruits of our labor in the past, present and future. As new currency is injected into a stagnating economy, the purchasing power of labor’s earnings declines. The only way to keep from sinking is to borrow money, which siphons off labor’s earnings via debt service to those who get the new fiat currency: the banks, financiers and corporations.

The near-infinite creation of new currency devalues past labor by destroying the value of pensions and savings, devalues the value of today’s labor and of labor’s future earnings.

Labor is stripped of value in two ways: the purchasing power of labor’s earnings are steadily devalued, and much of the remaining earnings are devoted to servicing debt that was taken on to stay afloat financially.

Meanwhile, those receiving the central banks’ free money for financiers can use this new currency (i.e. low-cost credit) to buy up income-producing assets and leverage speculations that reap enormous capital gains, as assets are never allowed to drop in value because “the Fed has our backs.”

And why does “the Fed has our backs”? Because the system implodes once debt and currency creation stop expanding.

Once we understand this mechanism, we understand that labor can never get ahead. No matter how hard one works, or how much one saves, the amount of “money” (fiat currency) that can be created and distributed to those at the top of the wealth-power pyramid will always be near-infinite, and the more credit / debt / currency that’s issued, the greater the loss of labor’s purchasing power.

This simple mechanism–labor is finite but money is infinite–is driving the world’s social, political and financial unraveling. Global debt 2019 now totals $246 trillion, a staggering 320% of global GDP, and there is nothing restraining it from climbing to $300 trillion, $400 trillion and $500 trillion, while labor’s earnings are stealthily and relentlessly stripped of purchasing power. The derivative market is 800 trillion plus with no public visibility.. a giant house of cards , smoke and mirrors .The only solution is a labor-backed cryptocurrency which can only created by labor that works to benefit mankind ( many more details elsewhere )

Old and new approaches to measuring GDP

The old expenditures approach chart updated

OLD GDP can be calculated using the expenditures approach using the following equation:Y=C+I+G+X-M, equals, C, plus, I, plus, G, plus, X, minus, M Each component is described in the table below:

| Category | definition |

|---|---|

| C | consumption: spending by households Irrelevant now.. many vital to life services and products are provided without spending by individual consumers |

| I | investment: spending by businesses on capital and inventory although this continues, it no longer has any relevance to actual work performed and is managed by people with proven successful track records of helping mankind in a myriad of ways ( described in detail elsewhere ) |

| G | government spending: spending by all government entities on goods and services (but not transfer payments) governments no longer control any money |

| X | exports: goods and services produced within a country that are purchased in other countries no countries exist any longer |

| M | imports: goods and services that are produced in other countries but are purchased in your country. no countries exist any longer |

The old income approach

GDP can be calculated using the income approach using the following equation:Y=w+i+r+p Where each category refers to the income received from supplying one of the four economic resources:

| Category | definition |

|---|---|

| w | wages earned from labor .. changes to “hourly production of goods or services that help mankind” which is the only real measure of what used to be called wealth and is now defined as “all humans contribute to the common good “ |

| i | interest earned on capital there is no more interest charged or given on capital |

| r | rent earned on land there is no more rent paid on land , it is owned equally by everyone |

| p | profits earned on entrepreneurial talent there are no more “profits” that exist as it is classically defined. Good ideas will ALWAYS drive Teamhumanity to greater heights and will be recognized and celebrated like never before in history |

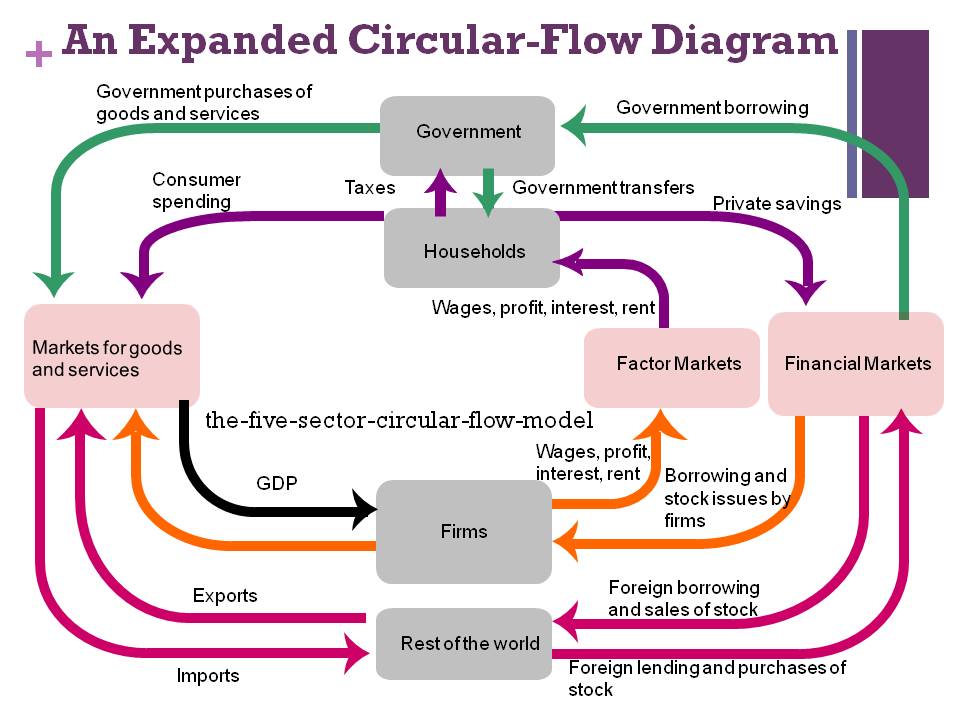

Old circular money flow methodology

Step by step changes