- ONE WORLD CURRENCY

Lovely idea look into details of this find more like it

Authored by José Antonio Ocampo, formerly United Nations Under-Secretary-General for Economic and Social Affairs, via Project Syndicate,

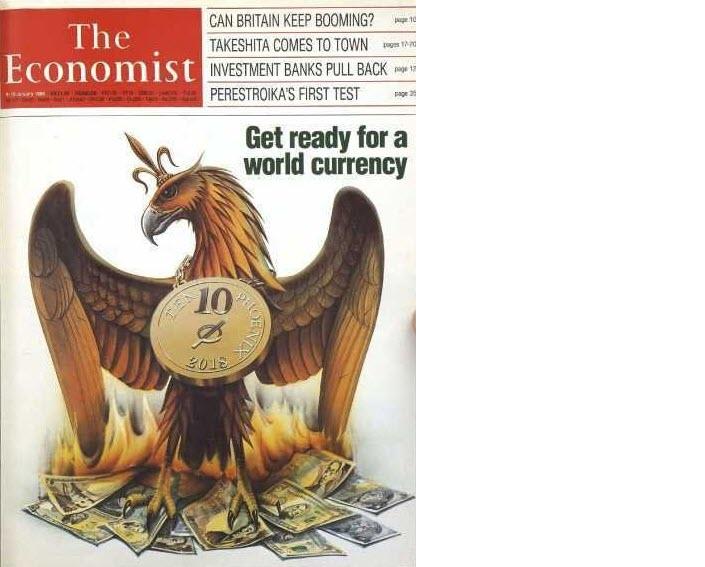

This year, the world commemorates the anniversaries of two key events in the development of the global monetary system. The first is the creation of the International Monetary Fund at the Bretton Woods conference 75 years ago. The second is the advent, 50 years ago, of the Special Drawing Right (SDR), the IMF’s global reserve asset.

When it introduced the SDR, the Fund hoped to make it “the principal reserve asset in the international monetary system.” This remains an unfulfilled ambition; indeed, the SDR is one of the most underused instruments of international cooperation. Nonetheless, better late than never: turning the SDR into a true global currency would yield several benefits for the world’s economy and monetary system.

The idea of a global currency is not new. Prior to the Bretton Woods negotiations, John Maynard Keynes suggested the “bancor” as the unit of account of his proposed International Clearing Union. In the 1960s, under the leadership of the Belgian-American economist Robert Triffin, other proposals emerged to address the growing problems created by the dual dollar-gold system that had been established at Bretton Woods. The system finally collapsed in 1971. As a result of those discussions, the IMF approved the SDR in 1967, and included it in its Articles of Agreement two years later.

Although the IMF’s issuance of SDRs resembles the creation of national money by central banks, the SDR fulfills only some of the functions of money. True, SDRs are a reserve asset, and thus a store of value. They are also the IMF’s unit of account. But only central banks – mainly in developing countries, though also in developed economies – and a few international institutions use SDRs as a means of exchange to pay each other.

The SDR has a number of basic advantages, not least that the IMF can use it as an instrument of international monetary policy in a global economic crisis. In 2009, for example, the IMF issued $250 billion in SDRs to help combat the downturn, following a proposal by the G20.

Most importantly, SDRs could also become the basic instrument to finance IMF programs. Until now, the Fund has relied mainly on quota (capital) increases and borrowing from member countries. But quotas have tended to lag behind global economic growth; the last increase was approved in 2010, but the US Congress agreed to it only in 2015. And loans from member countries, the IMF’s main source of new funds (particularly during crises), are not true multilateral instruments.

The best alternative would be to turn the IMF into an institution fully financed and managed in its own global currency – a proposal made several decades ago by Jacques Polak, then the Fund’s leading economist. One simple option would be to consider the SDRs that countries hold but have not used as “deposits” at the IMF, which the Fund can use to finance its lending to countries. This would require a change in the Articles of Agreement, because SDRs currently are not held in regular IMF accounts.

The Fund could then issue SDRs regularly or, better still, during crises, as in 2009. In the long term, the amount issued must be related to the demand for foreign-exchange reserves. Various economists and the IMF itself have estimated that the Fund could issue $200-300 billion in SDRs per year. Moreover, this would spread the financial benefits (seigniorage) of issuing the global currency across all countries. At present, these benefits accrue only to issuers of national or regional currencies that are used internationally – particularly the US dollar and the euro.

More active use of SDRs would also make the international monetary system more independent of US monetary policy. One of the major problems of the global monetary system is that the policy objectives of the US, as the issuer of the world’s main reserve currency, are not always consistent with overall stability in the system.

In any case, different national and regional currencies could continue to circulate alongside growing SDR reserves. And a new IMF “substitution account” would allow central banks to exchange their reserves for SDRs, as the US first proposed back in the 1970s.

SDRs could also potentially be used in private transactions and to denominate national bonds. But, as the IMF pointed out in its report to the Board in 2018, these “market SDRs,” which would turn the unit into fully-fledged money, are not essential for the reforms proposed here. Nor would SDRs need to be used as a unit of account outside the Fund.

The anniversaries of the IMF and the SDR in 2019 are causes for celebration. But they also represent an ideal opportunity to transform the SDR into a true global currency that would strengthen the international monetary system. Policymakers should seize it.

* * *

And just like that, the world is once again being primed and propagandized to desire this inevitability. Coming just a day after the Saudis threatened to end the Petrodollar, Ocampo’s op-ed is well-timed to say the least.

2) UNIVERSAL BASIC INCOME

otherwise known as universal everything in the setup .. needs major write up in all areas

by Tyler DurdenSat, 03/16/2019 – 22:201.0KSHARESTwitterFacebookRedditEmailPrint

Authored by Brandon Turbeville via The Organic Prepper blog,

Some well-informed Americans may be aware of China’s horrifying “Social Credit System” that was recently unveiled as a method of eradicating any dissent in the totalitarian state. Essentially freezing out anyone who does not conform to the state’s version of the ideal citizen, the SCS is perhaps the most frightening control system being rolled out today. That is, until you consider what is coming next.

Unbeknownst to most people, there appears to be a real attempt to create a system in which all citizens are rationed their “wages” digitally each month in place of a paycheck, including the ability to gain or lose money. This system would see any form of dissent resulting in the cut off of those credits and the ability to work, eat, or even exist in society. It would not only be the end of dissent but of any semblance of real individuality.ADVERTISING

Here’s how the Social Credit System operates in China.

First, however, for those who are unaware of the Social Credit System as it operates in China, we should briefly describe just what has taken place there. The Social Credit System in China isn’t merely a punishment for criticizing the state as is the case in most totalitarian regimes, the SCS can bring the hammer down for even the slightest infraction such as smoking in a non-smoking zone.

One summary of the SCS can be found in Business Insider’s article by Alexandra Ma entitled “China has started ranking citizens with a creepy ‘social credit’ system — here’s what you can do wrong, and the embarrassing, demeaning ways they can punish you,” where Ma writes,

The Chinese state is setting up a vast ranking system that will monitor the behavior of its enormous population, and rank them all based on their “social credit.”

The “social credit system,” first announced in 2014, aims to reinforce the idea that “keeping trust is glorious and breaking trust is disgraceful,” according to a government document.

The program is due to be fully operational nationwide by 2020, but is being piloted for millions of people across the country already. The scheme will be mandatory.

At the moment the system is piecemeal — some are run by city councils, others are scored by private tech platforms which hold personal data.

Like private credit scores, a person’s social score can move up and down depending on their behavior. The exact methodology is a secret — but examples of infractions include bad driving, smoking in non-smoking zones, buying too many video games and posting fake news online. (source)

The article points out that violating the “social code,” can result in being banned from flying or using the train, using the internet, decent schooling, getting a job, staying in hotels, and having your pet taken away. China is also taking advantage of the mob mentality by branding violators as “bad citizens.”

Almost everyone one of these “punishments” have already taken place in China as of the writing of this article and the country has announced its plans to have the system fully in place and functioning by 2020.

The most frightening part? That system is coming HERE. Soon.

While most Americans have scarcely noticed their descent into a police state, they are quick to dismiss the idea that such a system could be implemented in the land they still perceive to be free. However, all the moving parts are in place in the United States. They only need to come together to form the Social Credit System here.

And they are coming together.

Social media is one important method of judging “social scores.” This is mainly because of the willful posting of social media users on virtually every aspect of their lives. This data is extremely useful to governments who monitor and store the information acquired freely by users who give away the most personal and intimate details of their lives and do so without charge.

Whether it is political opinions, pictures of yourself and your food, or private conversations over Messenger, that data is being sent directly to the corporation and respective governments then have access to that data via a variety of means and they put that data to good use.

But despite the fact that social media acts as a giant web, snatching users information and acting as a useful tool of NGOs and governments in engineering social movements and human behavior, major social media outlets like Facebook and Twitter have become ubiquitous and common. They are nearly as essential communication tools for the 21st Century as telephones were for the 20th.

The Social Credit System goes along with the dark side of social media.

This is also despite the fact that social media has been proven to make its users depressed, angry, and less social. Much like any other drug, however, social media is addictive, causing real-world loss of quality of life while the user simply cannot tear himself away even when he knows it is best for him to do so. For that reason, it appears social media, whatever platform it may take, is here to stay. It’s also an important part of the structure of the coming technological control grid.

But beyond the negative effects social media has on the mind of the individual or in the creation of top-down social movements, the “internet mob mentality” has now become a fact of American life. Any celebrity, business owner, or just a regular person can be subject to digital flash mobbing simply as a result of a 2-second picture ( see the MAGA hat kids or the Chipotle girl, for instance) where a person’s reputation is destroyed, their job/business is lost, or their career is over as a result of virtue signaling and “outrage” by masses of people on the internet who are simply following what they believe the rest of the herd is doing. We are in the age of digital lynchings. It doesn’t matter whether the victim was truly wrong. What matters is that he/she is punished as harshly as possible.

The Social Credit System goes along with the move to a cashless society.

And then we must address the coming cashless society. Indeed, we already live in a world that is replacing cash with digital currency. In some cases, the move to become cashless is made by social engineering and predatory marketing to convenience. In others, such as India, the cashless society has been brought forward by law.

As I have written in many articles in the past, cashless programs are almost always first introduced under the guise of convenience. Then, as more and more people take the bait, the older methods of payment are seen as cumbersome and, eventually, are phased out completely. Mandates then replace what was once a personal choice.

Yet, what is so ironic about these programs is that, while the program is touted as providing so much more convenience, even when putting privacy and Cashless Society issues aside and, with the program running at its optimum, they aren’t often really much more convenient.

But that doesn’t stop the rollouts and it certainly doesn’t stop the mandates. It’s as if people believe that masses of scientists, corporations, and DARPA are putting their noses to the grindstone for their convenience and not some other purpose. Do we really believe that those organizations have, as their top priority, our health, freedom, convenience, or happiness? Do we really believe this or do we just not think about it at all?

Regardless, with the disappearance of cash also goes the ability to live outside the mandates of the State which has always been the goal of moving toward a cashless system. The United States is rapidly approaching the phase out of cash as a means of exchange. Don’t believe it? Just go to your local convenience store with a $100 dollar bill.

Enter the Universal Basic Income scheme.

Then there’s Universal Basic Income. The UBI has been tossed around as a legitimate solution to poverty and violation of workers’ rights for some time. It’s an old idea and even establishment philosophers/activists like Bertrand Russell espoused it in the early 20th Century. But while economists debate the idea’s success in regards to those two issues, no one seems to notice how the UBI, taken in concert with cashless society and social media addiction, will coalesce to produce just the world mentioned at the beginning of this article.

Without getting into the details of why a UBI is a bad idea in terms of society and economics, it is still useful to point out that the building blocks of the technological control grid are already in place and, with a UBI, those building blocks form a rather solid foundation.

Here’s how the Social Credit System is already being used in America.

With the ubiquitous presence of social media and the current culture of social media outrage, the social credit scheme is already in place. The State only needs to implement a coherent strategy that is no doubt itself already in place and merely waiting to be rolled out. Already, employers are able to check prospective employees’ credit scores on a condition of hiring and many now require social media passwords for the same reason. The SCS is right around the corner.

Pair the SCS with the UBI, however, and you can easily see how the SCS can be the litmus test for whether or not you receive your “benefits.” This means that, in the very near future, we will see someone who dares say something politically incorrect, makes a bad financial decision, or drinks before 10 am, literally frozen out of society.

If the government (or some private corporation) is in charge of doling out your “benefits” and the government/corporation is in charge of rating your social credit, what do we think is going to happen to violators? Already, governments are cutting social safety net payments to individuals who do not meet what those governments deem to be “acceptable” healthcare decisions. Similar schemes are in place where recipients are drug tested as part of the requirement for receiving “benefits.”

This is how society progresses into totalitarianism, by the way.

There are no doubt some readers of this article who were horrified at the society described within it but who then reached the paragraph above and justified the methods currently used against “welfare families.” The truth is that those readers are just another step in bringing this system about.

Now a younger generation is being used for the same purposes, manipulated by social engineers and reinforced by the generation before them, of bringing in the technological control grid, one giant leap at a time.

Of course, many people who read dire predictions such as these may be tempted to laugh at the idea that such a system could be implemented in the United States, one thing is for sure – the Chinese aren’t laughing. And we shouldn’t be either.

3) The Number Of Americans With “No Religion” Has Soared 266% Over The Last 3 Decades

All formal religions will hand over everything of value to the rest of the world, but their teachings and dedicated people all can certainly continue to contribute greatly to the betterment of mankind.

In the same vein …..

any replacement for, or additions to, existing religious organizations, or other gatherings of people, with different organization names, wishing to pursue happiness for all of mankind in many any new ways for the entire world .

Authored by Michael Snyder via The End of The American Dream blog,

Over the last 30 years, there has been a mass exodus out of organized religion in the United States. Each year the needle has only moved a little bit, but over the long-term what we have witnessed has been nothing short of a seismic shift. Never before in American history have we seen such dramatic movement away from the Christian faith, and this has enormous implications for the future of our nation. According to a survey that was just released, the percentage of Americans that claim to have “no religion” has increased by 266 percent since 1991…

The number of Americans who identify as having no religion has risen 266 percent since 1991, to now tie statistically with the number of Catholics and Evangelicals, according to a new survey.

People with no religion – known as ‘nones’ among statisticians – account for 23.1 percent of the U.S. population, while Catholics make up 23 percent and Evangelicals account for 22.5 percent, according to the General Social Survey.

In other words, the “nones” are now officially the largest religious group in the United States.

At one time it would have been extremely difficult to imagine that one day the “nones” would someday surpass evangelical Christians, but it has actually happened.

And the biggest movement that we have seen has been among our young people. According to a different survey, two-thirds of Christian young adults say that they stopped going to church at some point between the ages of 18 and 22…

Large numbers of young adults who frequently attended Protestant worship services in high school are dropping out of church.

Two-thirds of young people say they stopped regularly going to church for at least a year between the ages of 18 and 22, a new LifeWay Research surveyshows.

These are the exact same patterns that we saw happen in Europe, and now most of those countries are considered to be “post-Christian societies”.

The young adults of today are going to be the leaders of tomorrow, and they have a much higher percentage of “nones” than the population as a whole. According to a study that was conducted a while back by PRRI, 39 percent of our young adults are “religiously unaffiliated” at this point…

Today, nearly four in ten (39%) young adults (ages 18-29) are religiously unaffiliated—three times the unaffiliated rate (13%) among seniors (ages 65 and older). While previous generations were also more likely to be religiously unaffiliated in their twenties, young adults today are nearly four times as likely as young adults a generation ago to identify as religiously unaffiliated. In 1986, for example, only 10% of young adults claimed no religious affiliation.

To go from 10 percent during Ronald Reagan’s second term to 39 percent today is an absolutely colossal shift.

Right now, only about 27 percent of U.S. Millennials attend church on a regular basis. Most of them simply have no interest in being heavily involved in organized religion.

And even the young people that are involved in church do not seem very keen on sharing their faith with others. According to one of the most shocking surveys that I have seen in a long time, 47 percent of Millennials that consider themselves to be “practicing Christians” believe that it is “wrong” to share the gospel with others…

A new study from the California-based firm Barna Group, which compiles data on Christian trends in American culture, has revealed a staggering number of American millennials think evangelism is wrong.

The report, commissioned by the discipleship group Alpha USA, showed a whopping 47 percent of millennials — born between 1984 and 1998 — “agree at least somewhat that it is wrong to share one’s personal beliefs with someone of a different faith in hopes that they will one day share the same faith.”

These numbers are hard to believe, but they are from some of the most respected pollsters in the entire country.

Politically, these trends indicate that America is likely to continue to move to the left. Those that have no religious affiliation are much, much more likely to be Democrats, and so this exodus away from organized religion is tremendous news for the Democratic Party.

In a previous article, I documented the fact that somewhere between 6,000 and 10,000 churches in the United States are dying each year.

That means that more than 100 will die this week.

And thousands more are teetering on the brink. In fact, most churches in America have less than 100 people attending each Sunday…

A majority of churches have fewer than 100 people attending services each Sunday and have declined or nearly flatlined in membership growth, according to a new study from Exponential by LifeWay Research.

The study, which was conducted to help churches better understand growth in the pews, showed that most Protestant churches are not doing well attracting new Christian converts, reporting an average of less than one each month.

But even among all the bad news, there are some promising signs for the Christian faith. The home church movement if flourishing all over the country, and many of those home fellowships are focused on getting back to the roots of the Christian faith. All throughout history there have been relentless attempts to destroy the Christian faith, and yet it is still the largest faith in the entire world.

However, there is no doubt that Christianity is in decline throughout the western world, and churches are dying one after another.

This is what one pastor had to say about the slow death of his church…

‘My church is on the decline,’ he said. ‘We had 50 (congregants) in 2005 and now we have 15. We’re probably going to have to close (in a few years).’

‘Mainline Christianity is dying,’ he added. ‘It’s at least going away. It makes me feel more comfortable that it’s not my fault or my church’s fault. It’s part of a bigger trend that’s happening.’

John Adams, the second president of the United States, once said the following about our form of government…

Our Constitution was made only for a moral and religious People. It is wholly inadequate to the government of any other.

As America has turned away from the Christian faith, we have become steadily less moral and steadily less religious.

If we continue down this path, many believe that the future of our nation is going to be quite bleak indeed

4)

review in detail and revise as necessary KEY PIECE

Why and How Capitalism Needs to Be Reformed (Part 1)

Published on April 4, 2019

Ray DalioFollow

Co-Chief Investment Officer & Co-Chairman of Bridgewater Associates, L.P.

- Like2,977

- Comment488

- Share529

Summary

I was fortunate enough to be raised in a middle-class family by parents who took good care of me, to go to good public schools, and to come into a job market that offered me equal opportunity. I was raised with the belief that having equal opportunity to have basic care, good education, and employment is what is fair and best for our collective well-being. To have these things and use them to build a great life is what was meant by living the American Dream.

At age 12 one might say that I became a capitalist because that’s when I took the money I earned doing various jobs, like delivering newspapers, mowing lawns, and caddying and put it in the stock market when the stock market was hot. That got me hooked on the economic investing game which I’ve played for most of the last 50 years. To succeed at this game I needed to gain a practical understanding of how economies and markets work. My exposure to most economic systems in most countries over many years taught me that the ability to make money, save it, and put it into capital (i.e., capitalism) is the most effective motivator of people and allocator of resources to raise people’s living standards. Over these many years I have also seen capitalism evolve in a way that it is not working well for the majority of Americans because it’s producing self-reinforcing spirals up for the haves and down for the have-nots. This is creating widening income/wealth/opportunity gaps that pose existential threats to the United States because these gaps are bringing about damaging domestic and international conflicts and weakening America’s condition.

I think that most capitalists don’t know how to divide the economic pie well and most socialists don’t know how to grow it well, yet we are now at a juncture in which either a) people of different ideological inclinations will work together to skillfully re-engineer the system so that the pie is both divided and grown well or b) we will have great conflict and some form of revolution that will hurt most everyone and will shrink the pie.

I believe that all good things taken to an extreme can be self-destructive and that everything must evolve or die. This is now true for capitalism. In this report I show why I believe that capitalism is now not working for the majority of Americans, I diagnose why it is producing these inadequate results, and I offer some suggestions for what can be done to reform it. Because this report is rather long, I will present it in two parts: part one outlining the problem and part two offering my diagnosis of it and some suggestions for reform.

Why and How Capitalism Needs to Be Reformed

Before I explain why I believe that capitalism needs to be reformed, I will explain where I’m coming from, which has shaped my perspective. I will then show the indicators that make it clear to me that the outcomes capitalism is producing are inconsistent with what I believe our goals are. Then I will give my diagnosis of why capitalism is producing these inadequate outcomes and conclude by offering some thoughts about how it can be reformed to produce better outcomes. As there is a lot in this, I will present it in two parts, releasing Part 1 today and Part 2 tomorrow.

Part 1

Where I’m Coming From

I was lucky enough to grow up in a middle-class family raised by parents who cared for me, to be educated in a good public school, and to be able to go into a job market that offered me equal opportunity. One might say that I lived the American Dream. At the time, I and most everyone around me believed that we as a society had to strive to provide these basic things (especially equal education and equal job opportunity) to everyone. That was the concept of equal opportunity, which most people believed to be both fair and productive.

I suppose I became a capitalist at age 12 because that’s when I took the money I earned from doing various jobs like delivering newspapers, mowing lawns, and caddying, and put it in the stock market when the stock market was hot in the 1960s. That got me hooked on the investing game. I went to college and graduate school even though I didn’t have enough money to pay the tuitions because I could borrow the money from a government student loan program. Then I entered a job market that provided me equal opportunity, and I was on my way.

Because I loved playing the markets I chose to be a global macro investor, which is what I’ve been for about 50 years. That required me to gain a practical understanding of how economies and markets work. Over those years, I’ve had exposure to all sorts of economic systems in most countries and have come to understand why the ability to make money, save it, and put it into capital (i.e., capitalism) is an effective motivator of people and allocator of resources that raises people’s living standards. It is an effective motivator of people because it rewards people for their productive activities with money that can be used to get all that money can buy. And it is an effective allocator of resources because the creation of profit requires that the output created is more valuable than the resources that go into creating it. Being productive leads people to make money, which leads them to acquire capital (which is their savings in investment vehicles), which both protects the saver by providing money when it is later needed and provides capital resources to those who can combine them with their ideas and convert them into the profits and productivities that raise our living standards. That is the capitalist system.

Over those many years, I have seen communism come and go and have seen that all countries that made their economies work well, including “communist China,” have made capitalism an integral part of their systems for these reasons. Communism’s philosophy of “from each according to his ability, to each according to his needs” turned out to be naïve because people were not motivated to work hard if they didn’t get commensurately rewarded, so prosperity suffered. Capitalism, which connects pay to productivity and creates efficient capital markets that facilitate savings and the availability of buying power to fuel people’s productivity, worked much better.

I’ve also studied what makes countries succeed and fail by taking a mechanistic perspective rather than an ideological one because my ability to deal with economies and markets in a practical way is what I have been scored on. If you’d like to see a summary of my research that shows what makes countries succeed and fail, it’s here (link). In a nutshell, poor education, a poor culture (one that impedes people from operating effectively together), poor infrastructure, and too much debt cause bad economic results. The best results come when there is more rather than less of: a) equal opportunity in education and in work, b) good family or family-like upbringing through the high school years, c) civilized behavior within a system that most people believe is fair, and d) free and well-regulated markets for goods, services, labor, and capital that provide incentives, savings, and financing opportunities to most people.

Naturally, I have watched these things closely over the years in all countries, especially in the US. I will now show the results that our system is producing that have led me to believe capitalism isn’t working well for most Americans.

Why I Believe That Capitalism Is Not Working Well for Most Americans

In this section, I will show you a large batch of stats and charts that paint the picture. Perhaps there are too many for your taste. If you feel that you’re getting past the point of diminishing returns, I suggest that you either quickly scan the rest by just reading the sentences in bold or skip ahead to the next section which explains why I think that not reforming capitalism would be an existential threat to the US.

To begin, I’d like to show you the differences that exist between the haves and the have-nots. Because these differences are hidden in the averages, I broke the economy into the top 40% and the bottom 60% of income earners.[1] That way we could see what the lives of the bottom 60% (i.e., the majority) look like and could compare them with those of the top 40%. What I found is shown in this study. While I suggest that you read it, I will quickly give you a bunch of stats that paint the picture here.

There has been little or no real income growth for most people for decades. As shown in the chart below on the left, prime-age workers in the bottom 60% have had no real (i.e., inflation-adjusted) income growth since 1980. That was at a time when incomes for the top 10% have doubled and those of the top 1% have tripled.[i] As shown in the chart to the right, the percentage of children who grow up to earn more than their parents has fallen from 90% in 1970 to 50% today. That’s for the population as a whole. For most of those in the lower 60%, the prospects are worse.

![[ii]](https://media.licdn.com/dms/image/C4D12AQE3dvBxqDZs0g/article-inline_image-shrink_400_744/0?e=1560384000&v=beta&t=2U6io7JWE3oohMFDJ61HHm9TKM7R-guugCxFn-98zlE)

![[iii]](https://media.licdn.com/dms/image/C4D12AQF4AaDW6KFFUg/article-inline_image-shrink_1000_1488/0?e=1560384000&v=beta&t=L7-npEj3qtYnC9pQ2GJ9cKdLeT_G0gYTz4oT8wW0JDk)

As shown below, the income gap is about as high as ever and the wealth gap is the highest since the late 1930s. Today, the wealth of the top 1% of the population is more than that of the bottom 90% of the population combined, which is the same sort of wealth gap that existed during the 1935-40 period (a period that brought in an era of great internal and external conflicts for most countries). Those in the top 40% now have on average more than 10 times as much wealth as those in the bottom 60%.[iv] That is up from six times in 1980.

![[v]](https://media.licdn.com/dms/image/C4D12AQFa3SU8uzTesA/article-inline_image-shrink_400_744/0?e=1560384000&v=beta&t=kyvSelAf4rPYadKewMPFI2Hb2yHpFeX66HmLs8gup7E)

The following charts show real income growth by quintiles for the overall population since 1970. Ask yourself which one you’re in. That probably has given you your perspective. My objective is to show you the broader perspective.

Most people in the bottom 60% are poor. For example, only about a third of the bottom 60% save any of their income in cash or financial assets.[vii] According to a recent Federal Reserve study, 40% of all Americans would struggle to raise $400 in the event of an emergency.[viii]

And they are increasingly getting stuck being poor. The following chart shows the odds of someone in the bottom quintile moving up to the middle quintile or higher in a 10-year period. Those odds declined from about 23% in 1990 to only 14% as of 2011.

![[ix]](https://media.licdn.com/dms/image/C4D12AQFQtfP9jd2B-g/article-inline_image-shrink_1000_1488/0?e=1560384000&v=beta&t=h0M64Een6UKVLAWj7TaM97DZwBbo_6GE65dSxQfp36Y)

While most Americans think of the US as being a country of great economic mobility and opportunity, its economic mobility rate is now one of the worst in the developed world for the bottom. As shown below, in the US, people in the bottom income quartile have a 40% chance of having a father in the bottom quartile (in the father’s prime earning years) and people in the top quartile have only about an 8% chance of having a father in the bottom quartile, suggesting half of the average probability of moving up and one of the worst probabilities of the countries analyzed. In a country of equal opportunity, that would not exist.

One’s income growth results from one’s productivity growth, which results from one’s personal development. So let’s look at how we are developing people. Let’s start with children.

To me, the most intolerable situation is how our system fails to take good care of so many of our children. As I will show, a large number of them are poor, malnourished (physically and mentally), and poorly educated. More specifically:

- The childhood poverty rate in the US is now 17.5% and has not meaningfully improved for decades.[xi] In the US in 2017, around 17% of children lived in food-insecure homes where at least one family member was unable to acquire adequate food due to insufficient money or other resources.[xii] Unicef reports that the US is worse than average in the percent of children living in a food-insecure household (with the US faring worse than Poland, Greece, and Chile).[xiii]

The domino effects of these conditions are costly. Low incomes, poorly funded schools, and weak family support for children lead to poor academic achievement, which leads to low productivity and low incomes of people who become economic burdens on the society.

Though there are bright spots in the American education system such as our few great universities, the US population as a whole scores very poorly relative to the rest of the developed world in standardized tests for a given education level. More specifically:

- Looking at the most respected (PISA) test scores, the US is currently around the bottom 15th percentile of the developed world. As shown below, the US scores lower than virtually all developed countries other than Italy and Greece. That stands in the way of many people having adequate living standards and of US competitiveness.

![[xiv]](https://media.licdn.com/dms/image/C4D12AQESFenyQsHQYw/article-inline_image-shrink_1500_2232/0?e=1560384000&v=beta&t=JRfzG9QdrHwQhmzbjkAfVq_AfQpfFoYlLeA1EAitAsI)

Differences in these scores are tied to poverty levels—i.e., high-poverty schools (measured by the share of students eligible for free/reduced-price lunch) have PISA test scores around 25% lower than schools with the lowest levels of poverty.

![[xv]](https://media.licdn.com/dms/image/C4D12AQE1ELQB2KW9yg/article-inline_image-shrink_1000_1488/0?e=1560384000&v=beta&t=iLDImx1XFE8hAp9rIsDEAWXHxw_daQRwg_qyeIor09A)

- Among developed (i.e., OECD) countries, the US has the third-worst difference in shortages of teaching staff between advantaged and disadvantaged schools.

![[xvi]](https://media.licdn.com/dms/image/C4D12AQFt2laYPxdMQw/article-inline_image-shrink_1500_2232/0?e=1560384000&v=beta&t=HKpMd0fTEvwbKvS554GgUh9iAlfsilmPB_bKambnX40)

The stats that show that the US does a poor job of tending to the needs of its poor students relative to how most other countries do it are never-ending. Here are a few more:

- The proportion of disadvantaged students who have at least a year of pre-primary education is lower in the US compared to the average OECD country.[xvii]

- Among OECD countries, the US has the second-worst child poverty rate as of 2008 among single-parent households who aren’t working—a failure of the social safety net.[xviii]

These poor educational results lead to a high percentage of students being inadequately prepared for work and having emotional problems that become manifest in damaging behaviors. Disadvantaged students in the US are far more likely to report social and/or emotional issues than in most other developed countries, including not being socially integrated at school, severe test anxiety, and low satisfaction with life.

- 34% of high-poverty schools experienced high levels of chronic student absence, versus only 10% of high-income schools.[xx] Even in Connecticut, one of the wealthiest states by per capita income, 22% of youth are disengaged (i.e., either missing more than 25 days of school a year, failing two or more courses, or being suspended multiple times) or disconnected (young people not enrolled in school and without a high school degree).[xxi] Disconnected youth in Connecticut are five times more likely to end up incarcerated and 33% more likely to be struggling with substance abuse (full report linked here).

- Comparing the high school graduation rates of Connecticut school districts to child poverty rates shows a tight relationship across the state: a 1% higher child poverty rate equates to about 1% lower graduation rates.

- Across states, there is a strong relationship between spending per student and educational outcomes.

Scatters of Educational Spending and Outcomes for US States

![[xxiii]](https://media.licdn.com/dms/image/C4D12AQGCMGGRnacUCw/article-inline_image-shrink_1500_2232/0?e=1560384000&v=beta&t=k8U4ZyvJW17dgmdzpHX_BVdFVzyMkwkVljCAvdfCCZU)

- Recent research for the US suggests that children under age 5 who were granted access to food stamps experienced better health and education outcomes—an estimated 18% increase in high school graduation rates—which led them to be much less likely to rely on other welfare programs later in life.[xxiv]

- Students who come from poor families and try to go to college are less well prepared. For example, those who come from families earning less than $20,000 score on average 260 points (out of 1600) worse on the SAT than students from families earning $200,000+ do, and the gap is increasing.[xxv] The gap in test scores between children at the top and bottom of the income distribution is estimated to be 75% higher today than it was in the early 1940s, according to a 2011 study.[xxvi]

- Yet children living in poorer neighborhoods on average receive about $1,000 less state and local funding per student than those in the more prosperous neighborhoods.[xxvii] This is despite the fact that the federal government (according to its Title I funding formula) assumes it costs a district 40% more per year to educate lower-income students to the same standard as typical students.[xxviii] As a result, schools in low-income areas are typically severely underfunded. On average, in public schools 94% of teachers have to pay for supplies with their own money—often including basic cleaning supplies—and it is worse in the poorest public schools.[xxix]

- A related problem is that many teachers who have to deal with these stressful conditions are underpaid and under-respected. When I was growing up, doctors, lawyers, and teachers were the most respected professions. Now, teachers make only 68% of what other university graduates make, which is significantly less than they make in other OECD developed countries.[xxx] Even looking at weekly earnings to adjust for the length of the school year and controlling for other things that impact pay (like age and years of experience), teachers earned 19% less than comparable workers in 2017, versus only 2% less in 1994.[xxxi] Even worse, they don’t get the respect that they deserve.

The income/education/wealth/opportunity gap reinforces the income/education/wealth/opportunity gap:

- Richer communities tend to have public schools that are far better funded than poorer communities, which reinforces the income/wealth/opportunity gap. One of the main reasons for this funding gap is that the Constitution made education a state issue, and most states made local schools primarily locally funded so that rich towns have well-funded public schools and poor towns have poorly funded public schools. More specifically, around 45% of school funding comes from local governments, primarily through property taxes, while only around 8% comes from the federal government, and the rest is from state governments.[xxxii] Thus, there can be enormous variations in the wealth/income of individual communities. Also, the top 40% of income earners spend almost five times as much on their children’s education as the bottom 60% of income earners do, while those in the top 20% spend about six times as much as those in the bottom 20% do.[xxxiii]

- Underfunded public schools are suffering in quality. For instance, PISA data shows that students at US schools with significant teaching staff shortages score 10.5% worse on testing than students at schools with no teacher shortages. Similarly, a shortage of lab equipment is associated with a 16.7% drop in student scores, and shortages of library materials are associated with a 15.1% drop in student scores.[xxxiv]

- By comparison, private schools on average both spend considerably more on students and produce better outcomes. Private schools in the US spend about 70% more per student than public schools do, with the median private school spending about $23,000 per student in 2016, compared to about $14,000 for the average public school.[xxxv] This higher spending translates to higher test scores: in the last round of PISA testing, US private school students scored on average 4.3% higher than public school students across math, reading, and science exams. Over the three PISA surveys since 2009, private school students have scored on average 6.9% higher.[xxxvi]

- Not surprisingly, Americans have much less confidence in public schools today than they have had at any point over the last five decades. Today, only 29% of Americans have a “great deal” or “quite a lot” of trust in the public education system. In 1975, 62% of Americans trusted public schools.[xxxvii]

To me, leaving so many children in poverty and not educating them well is the equivalent of child abuse, and it is economically stupid.

The weakening of the family and good parental guidance has also been an important adverse influence:

Here are a few stats that convey how the family unit has changed over the years:

- In 1960, 73% of children lived with two married parents who had never been divorced, and 13% lived in a household without two married parents.[2] In 2014, the share of children living in a household without two married parents was 38% (and now less than half live in households with two parents in a first marriage). Those stats are for the average of all households in the US. The family support for those in low-education, low-income households is much less. Around 60% of children of parents with less than high school education don’t live in households with two married parents, while only 14% of children of parents who graduated college are in such households.[xxxviii]

- The probability of being incarcerated is closely related to education levels: among Americans aged 28-33, 35% of male high school dropouts have been incarcerated versus around 10% of male high school graduates and only 2% of male college graduates.[xxxix]

- Between 1991 and 2007, the number of children with a parent in state or federal prison grew 80%.[xl] Today, an estimated 2.7 million children in the US have a parent in prison or jail—that is 1 in every 28 children (3.6% of all children).[xli]

Bad childcare and bad education lead to badly behaved adults hence higher crime rates that inflict terrible costs on the society:

- The United States’ incarceration rate is nearly five times the average of other developed countries and three times that of emerging countries.[xlii] The direct cost of keeping people incarcerated is staggering and has grown rapidly: state correctional costs quadrupled over the past two decades and now top $50 billion a year, consuming 1 in every 15 general fund dollars.[xliii]

- This bad cycle perpetuates itself as criminal/arrest records make it much more difficult to find a job, which depresses earnings. Serving time, even relatively brief periods, reduces hourly wages for men by approximately 11%, the time employed by 9 weeks per year, and annual earnings by 40%.[xliv]

The health consequences and economic costs of low education and poverty are terrible:

- For example, for those in the bottom 60% premature deaths are up by about 20% since 2000.[xlv] Men from the lowest 20% of the income distribution can expect to live about 10 fewer years than men from the top 20%.[xlvi]

- The US is just about the only major industrialized country with flat/slightly rising premature death rates. The biggest contributors to that change are an increase in deaths by drugs/poisoning (having more than doubled since 2000) and an increase in suicides (up over 50% since 2000).[xlvii]

- Since 1990, the share of Americans who say that in the last year they put off medical treatment for a serious condition because of cost has roughly doubled, from 11% in 1991 to 19% today.[xlviii]

- Those who are unemployed or those making less than $35,000 per year have worse health, with 20% of each group reporting poor health, about three times the rate for the rest of the population.[xlix]

- The impacts of childhood poverty alone in the US are estimated to increase health expenditures by 1.2% of GDP.[L]

These conditions pose an existential risk for the US.

The previously described income/wealth/opportunity gap and its manifestations pose existential threats to the US because these conditions weaken the US economically, threaten to bring about painful and counterproductive domestic conflict, and undermine the United States’ strength relative to that of its global competitors.

These gaps weaken us economically because:

- They slow our economic growth because the marginal propensity to spend of wealthy people is much less than the marginal propensity to spend of people who are short of money.

- They result in suboptimal talent development and lead to a large percentage of the population undertaking damaging activities rather than contributing activities.

In addition to social and economic bad consequences, the income/wealth/opportunity gap is leading to dangerous social and political divisions that threaten our cohesive fabric and capitalism itself.

I believe that, as a principle, if there is a very big gap in the economic conditions of people who share a budget and there is an economic downturn, there is a high risk of bad conflict. Disparity in wealth, especially when accompanied by disparity in values, leads to increasing conflict and, in the government, that manifests itself in the form of populism of the left and populism of the right and often in revolutions of one sort or another. For that reason, I am worried what the next economic downturn will be like, especially as central banks have limited ability to reverse it and we have so much political polarity and populism.

The problem is that capitalists typically don’t know how to divide the pie well and socialists typically don’t know how to grow it well. While one might hope that when such economic polarity and poor conditions exist, leaders would pull together to reform the system to both divide the economic pie and make it grow better (which is certainly doable and the best path), they typically become progressively more extreme and fight more than cooperate.

In order to understand the phenomenon of populism, two years ago I did a study of it in which I looked at 14 iconic cases and observed the patterns and the forces behind them. If you are interested in it, you can read it here. In brief, I learned that populism arises when strong fighters/leaders of the right or of the left who are looking to fight and defeat the opposition come to power and escalate their conflict with the opposition, which typically galvanizes around comparably strong/fighting leaders. The most important thing to watch as populism develops is how conflict is handled—whether the opposing forces can coexist to make progress or whether they increasingly “go to war” to block and hurt each other and cause gridlock. In the worst cases, this conflict causes economic problems (e.g., via paralyzing strikes and demonstrations) and can even lead to moves from democratic leadership to autocratic leadership as happened in a number of countries in the 1930s.

We are now seeing conflicts between populists of the left and populists of the right increasing around the world in much the same way as they did in the 1930s when the income and wealth gaps were comparably large. In the US, the ideological polarity is greater than it has ever been and the willingness to compromise is less than it’s ever been. The chart on the left shows how conservative Republican senators and representatives have been and how liberal Democratic senators and representatives have been going back to 1900. As you can see, they are each more extreme and they are more divided than ever before. The chart on the right shows what percentage of them have voted along party lines going back to 1790, which is now the greatest ever. In other words, they have more polar extreme positions and they are more solidified in those positions than ever. And we are coming into a presidential election year. We can expect a hell of a battle.

It doesn’t take a genius to know that when a system is producing outcomes that are so inconsistent with its goals, it needs to be reformed. In the next part, I will explore why it is producing these substandard outcomes and what I think should be done to reform it.

You can find the full report (Part 1 & Part 2) here: https://www.linkedin.com/pulse/why-how-capitalism-needs-reformed-parts-1-2-ray-dalio/?published=t

[1] Actually, we broke it into many other subcategories and then aggregated them into these two groups for simplicity in presenting the results.

[i] https://wir2018.wid.world/part-2.htmldata

[ii] Based on data from the Current Population Survey. https://cps.ipums.org/cps/

[iii] http://www.equality-of-opportunity.org/papers/abs_mobility_paper.pdf, 34.

[iv] As of 2016; based on data from Survey of Consumer Finances.

[v] Income chart (on left) shows fiscal income shares. Data from World Inequality Database. (https://wid.world/country/usa/)

[vi] Data from Census Bureau

[vii] As of 2016; based on data from Survey of Consumer Finances.

[viii] Survey of Consumer Finances (https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf)

[ix] https://www.minneapolisfed.org/institute/working-papers/17-06.pdf

[x] https://www.oecd.org/social/soc/Social-mobility-2018-Overview-MainFindings.pdf; estimates for China based on Kelly Labar, “Intergenerational Mobility in China”, (https://halshs.archives-ouvertes.fr/halshs-00556982/document). Note that methodologies varied between countries in the OECD study.

[xi] US Census Bureau, Current Population Survey, 1960 to 2018 Annual Social and Economic Supplements, History Poverty Tables, Table 3.(https://www.census.gov/data/tables/time-series/demo/income-poverty/historical-poverty-people.html)

[xii] https://www.ers.usda.gov/webdocs/publications/90023/err-256.pdf, 10.

[xiii] https://www.weforum.org/agenda/2017/06/these-rich-countries-have-high-levels-of-child-poverty/

[xiv] http://www.oecd.org/pisa/data/

[xv] http://www.oecd.org/pisa/data/

[xvi] OECD (2016), PISA 2015 Results (Volume I): Excellence and Equity in Education, PISA, OECD Publishing, Paris, 231.

[xvii] OECD (2017), Educational Opportunity for All: Overcoming Inequality throughout the Life Course, OECD Publishing, Paris, 46.

[xviii] OECD (2017), Educational Opportunity for All: Overcoming Inequality throughout the Life Course, OECD Publishing, Paris, 60.

[xix] http://www.oecd.org/pisa/data/

[xx] http://new.every1graduates.org/wp-content/uploads/2018/09/Data-Matters_083118_FINAL-2.pdf

[xxii] Poverty data from Census Bureau SAIPE School District Estimates (https://www.census.gov/data/datasets/2013/demo/saipe/2013-school-districts.html); graduation rates from Hechinger Report (https://hechingerreport.org/the-gradation-rates-from-every-school-district-in-one-map/)

[xxiii] Note: Spending data is from the US Census Bureau and is current as of 2016. Test scores and proficiency data are from “National Report Card” assessments and are meant to be comparable across states. Data is from 2013. Only a limited sample of states have data for this Grade 12 assessment.

[xxiv] https://www.cbpp.org/research/food-assistance/snap-is-linked-with-improved-nutritional-outcomes-and-lower-health-care

[xxv] https://blogs.wsj.com/economics/2014/10/07/sat-scores-and-income-inequality-how-wealthier-kids-rank-higher/

[xxvi] https://cepa.stanford.edu/sites/default/files/reardon%20whither%20opportunity%20-%20chapter%205.pdf , 8.

[xxvii] https://edtrust.org/wp-content/uploads/2014/09/FundingGapReport_2018_FINAL.pdf, 4.

[xxviii] https://edtrust.org/wp-content/uploads/2014/09/FundingGapReport_2018_FINAL.pdf, 7.

[xxix] https://www.usatoday.com/story/money/personalfinance/2018/05/15/nearly-all-teachers-spend-own-money-school-needs-study/610542002/

[xxx] OECD (2017), “D3.2a. Teachers’ actual salaries relative to wages of tertiary-educated workers (2015)”, in The Learning Environment and Organisation of Schools, OECD Publishing, Paris, https://doi.org/10.1787/eag-2017-table196-en.

[xxxi] https://www.epi.org/publication/teacher-pay-gap-2018/

[xxxii] https://nces.ed.gov/programs/coe/indicator_cma.asp

[xxxiii] Data based on Consumer Expenditure Survey

[xxxiv] http://www.oecd.org/pisa/data/

[xxxv] Private school spending data from: https://www.nais.org/statistics/pages/nais-independent-school-facts-at-a-glance/ ; Public school spending data from: https://www.statista.com/statistics/203118/expenditures-per-pupil-in-public-schools-in-the-us-since-1990/

[xxxvi] http://www.oecd.org/pisa/data/

[xxxvii] https://news.gallup.com/poll/1612/education.aspx

[2] The remaining 14% lived with two parents in remarriages.

[xxxviii] http://www.pewsocialtrends.org/2015/12/17/1-the-american-family-today/

[xxxix] https://www.brookings.edu/research/twelve-facts-about-incarceration-and-prisoner-reentry/, 10

[xli] The Pew Charitable Trusts, Collateral Costs: Incarceration’s Effect on Economic Mobility, https://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2010/collateralcosts1pdf.pdf, 4.

[xlii] Calculations based on data from “World Prison Brief Database.” (http://www.prisonstudies.org/highest-to-lowest/prison_population_rate?field_region_taxonomy_tid=All)

[xliii] https://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2010/collateralcosts1pdf.pdf, 2.

[xliv] https://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2010/collateralcosts1pdf.pdf, 4.

[xlv] As of 2015; Bridgewater analysis, based on data from the CDC (https://www.cdc.gov/nchs/data_access/VitalStatsOnline.htm#Mortality_Multiple)

[xlvi] Chetty, Raj, et al., “The Association Between Income and Life Expectancy in the United States, 2001-2014”, Journal of the American Medical Association, 2016.

[xlvii] As of 2015; Bridgewater analysis, based on data from the CDC (https://www.cdc.gov/nchs/data_access/VitalStatsOnline.htm#Mortality_Multiple)

[xlviii] https://news.gallup.com/poll/4708/healthcare-system.aspx

[xlix] https://ftp.cdc.gov/pub/Health_Statistics/NCHS/NHIS/SHS/2014_SHS_Table_A-11.pdf

[L] https://www.americanprogress.org/issues/poverty/reports/2007/01/24/2450/the-economic-costs-of-poverty/’

[LI] https://voteview.com/data

Ray Dalio

Co-Chief Investment Officer & Co-Chairman of Bridgewater Associates, L.P.

Follow488 comments

Sign in to leave your comment

Bharat Sheth – Quest

—

James Morgan

—

Great analysis! Should be read by every one, particularly those in public office. However, his first charts showing income trend fails to take into consideration mobility of individuals into higher paying jobs. A study of census data over a ten year period showed that the people in the lowest 20% in year one, 85% of them migrated into a higher 20% group by the tenth year and 15% of them migrated to the highest 20% group! The charts in this presentation actually uses the lowest 20% every year, which includes people having their first job each year, who by definition have no income growth over time. 1hLikeReply

A. Galip Ulsoy

Professor Emeritus at University of Michigan

Makes a lot of sense to me! Hopefully voters will elect politicians who can make these changes.2hLikeReply

Rick Wilke

Operations Leader | Business Manager turning chaos into profit and sustainability | Safety First! | #ONO

I look forward to reading part 2. As taxes for infrastructure is a necessary evil, the power, corruption and abuse of such government sponsored programs leads to higher cost. Is healthcare an infrastructure cost? Some would argue yes, others no. Health cost have risen, quality care has decreased, as the US entered into socialized medicine. History shows regulations are needed at time to keep companies in check, but history also shows to much regulation leads to excessive cost, get out dated and ruin growth and production. Regulations, taxes and paper work are killing the backbone of America, the small business person. Should one make business decisions based on market demands or government intervention? Most decisions are on government intervention today. Just my capitalist 2 cent worth.

5 ) Forget “Money” – What Will Matter Are Water, Energy, Soil, & Food… And A Shared National Purpose

by Tyler DurdenTue, 05/28/2019 – 16:452SHARESTwitterFacebookRedditEmailPrint

Authored by Charles Hugh Smith via OfTwoMinds blog,

If you want to identify tomorrow’s superpowers, overlay maps of fresh water, energy, grain/cereal surpluses and arable land.

The status quo measures wealth with “money,” but “money” is not what’s valuable. “Money” (in quotes because the global economy operates on intrinsically valueless fiat currencies being “money”) is wealth only if it can purchase what’s actually valuable.

As the world slides into an era of scarcities, what will matter more than “money” are the essentials of survival: fresh water, energy, soil and the output of those three, food. The ability to secure these resources will separate nations that fail and those that survive.

In a world of abundance, it’s assumed every essential resource can be bought on the open market. Surpluses are placed on the market and anyone with “money” can buy the surplus.

Things work differently in scarcity: “money” buys zip, zero, nada because nobody with what’s scarce can afford to give it away for “money” which can no longer secure what’s scarce.

Parachute into a desert with gold, dollars, euros, yen and yuan, and since there’s nothing to buy, all your money is worthless. Once you’re thirsting to death, you’d give all your money away for a liter of fresh water. But why would anyone who needs that liter for their on survival trade it for useless “money”?

Imagine the longevity of a regime which sold the nation’s food while its populace went hungry. Not very long once the truth comes out.

Having resources is only one component: consumption is the other half of the picture. Having 4 million barrels a day of oil (MBPD) is nice if you’re only using 3 MBPD, but if you’re consuming 8 MBPD, you still need to import 4 MBPD.

Water and soil are not tradable commodities. Nations which share water resources (rivers and watersheds) have to negotiate (or fight wars over) the division of that scarce resource, but as a generality, fresh water and fertile soil can’t be bought and sold like grain and oil.

The number of nations with surplus energy and food to export is small. As I noted in Superbugs and the Ultimate Economic Weapon: Food, there are contingencies in food production which could quickly erase surpluses and exports and trigger widespread shortages that have the potential to unleash social unrest.

Energy exports are also a natural economic weapon with which to reward needy friends or punish desperate enemies (no oil or natural gas for you!).

But energy exports are also contingent: natural gas and oil pipelines can be blown up by non-state players, shipping chokepoints can be closed or mined, regimes can change overnight and so on.

The value of a nation’s currency can be understood as a reflection of its essential resources, what I have called the FEW resources (food, energy, water) which I would now amend to FEWS (food, energy, water, soil).

Nations which are frugal about creating currency (either via printing/issuance or borrowing it into existence) while prudently managing their fresh water, energy, soil and food will in effect be “backing” their currency with their surpluses of what will be increasingly scarce.

Nations which borrow into existence or emit currency profligately while having scarce FEWS resources and enormous needs for imported food and energy will find their currency rapidly loses value.

When there’s not enough energy and food to go around, who will trade what’s scarce and valuable for what’s abundant and worthless (“money”)? The answer is no one.

If you want to identify tomorrow’s superpowers, overlay maps of fresh water, energy, grain/cereal surpluses and arable land: those nations with abundances that can yield sustainable surpluses in food and energy while taking care of domestic needs will have wealth and power.

Those with diminishing resources that are inadequate to meet domestic demand will have very little wealth, no matter how much “money” they print or borrow into existence or how much consumerist “stuff” they produce.

There are two other attributes that matter: being able to defend your FEWS resources from would-be thieves and a widely shared national sense of purpose that enables shared sacrifice for the common good. Without that shared source of unity, the elites with wealth and power will grab more and more, bringing down the house around them with their limitless greed.

Sacrifice either starts at the top or it means nothing. Forcing commoners to suck up sacrifices only exacerbates disunity and national dissolution.

There are no guarantees that any nation will be able to assemble all that it will take to survive an era of scarcity. But some have better odds than others. Place your bets accordingly.

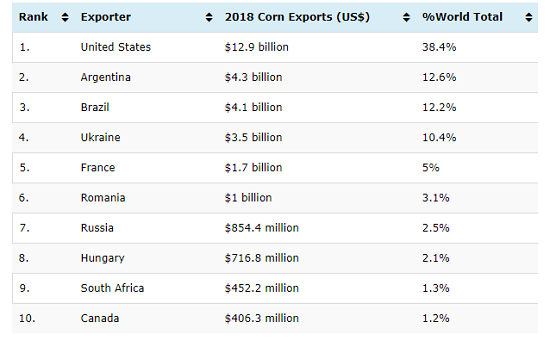

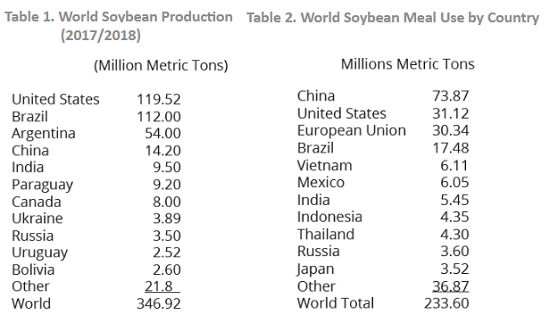

I’m reprinting these charts to emphasize how few nations have geopolitically meaningful surpluses of food.

Corn is often the primary food for livestock. No corn, not much meat.

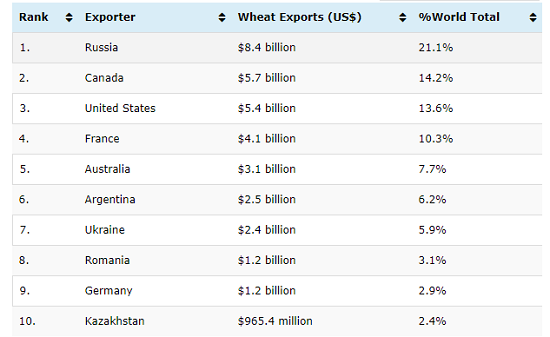

The exportable surpluses of wheat are concentrated in a few hands.

The same is true of soybeans, a source of protein in Asia and livestock feed everywhere. This chart shows the top producers and the top consumers.

* * *

6 Dalio: “Like It Or Not” Central Banking Is On Its Way Out; MMT Will “Inevitably” Replace It

by Tyler DurdenThu, 05/02/2019 – 09:502SHARESTwitterFacebookRedditEmailPrint

Following the publication of his ‘capitalist manifesto’ where he called for drastic reforms of the American capitalist system to redistribute wealth and resources more equitably – something he followed up with an unprecedented $100 million donation to the public schools in his home state of Connecticut, putting his money where his mouth is, so to speak – Ray Dalio’s self-published LinkedIn essays have been garnering a lot more attention. It probably didn’t hurt that Dalio’s essay appeared to set off a wave of wealthy capitalists talking about how “capitalism is broken”, placing him at the forefront of a trend that could have profound implications for American politics as Wall Street struggles to confront the rise of populism on the right and the left.

And so it is that late on Wednesday, Dalio published a follow-up where he expanded on a proposal that, as we noted at the time, sounded suspiciously similar to Modern Monetary Theory.Recommended videosPowered by AnyClipOil Races To Near Six-Month HighPlayUnmuteCurrent Time 0:00/Duration 0:32Loaded: 17.72% FullscreenUp Next

This time around, Dalio argued that, whether we like it or not, the US will eventually be forced to embrace MMT, this has become “inevitable,” he said. Central banking as we know it (which, thanks to rampant money printing in the post-crisis paradigm, has already moved closer to the MMTers ideal) is doomed to eventually collapse under its own weight and unpopularity. In other words, sooner or later, the people will demand MMT, once inequality gets bad enough.

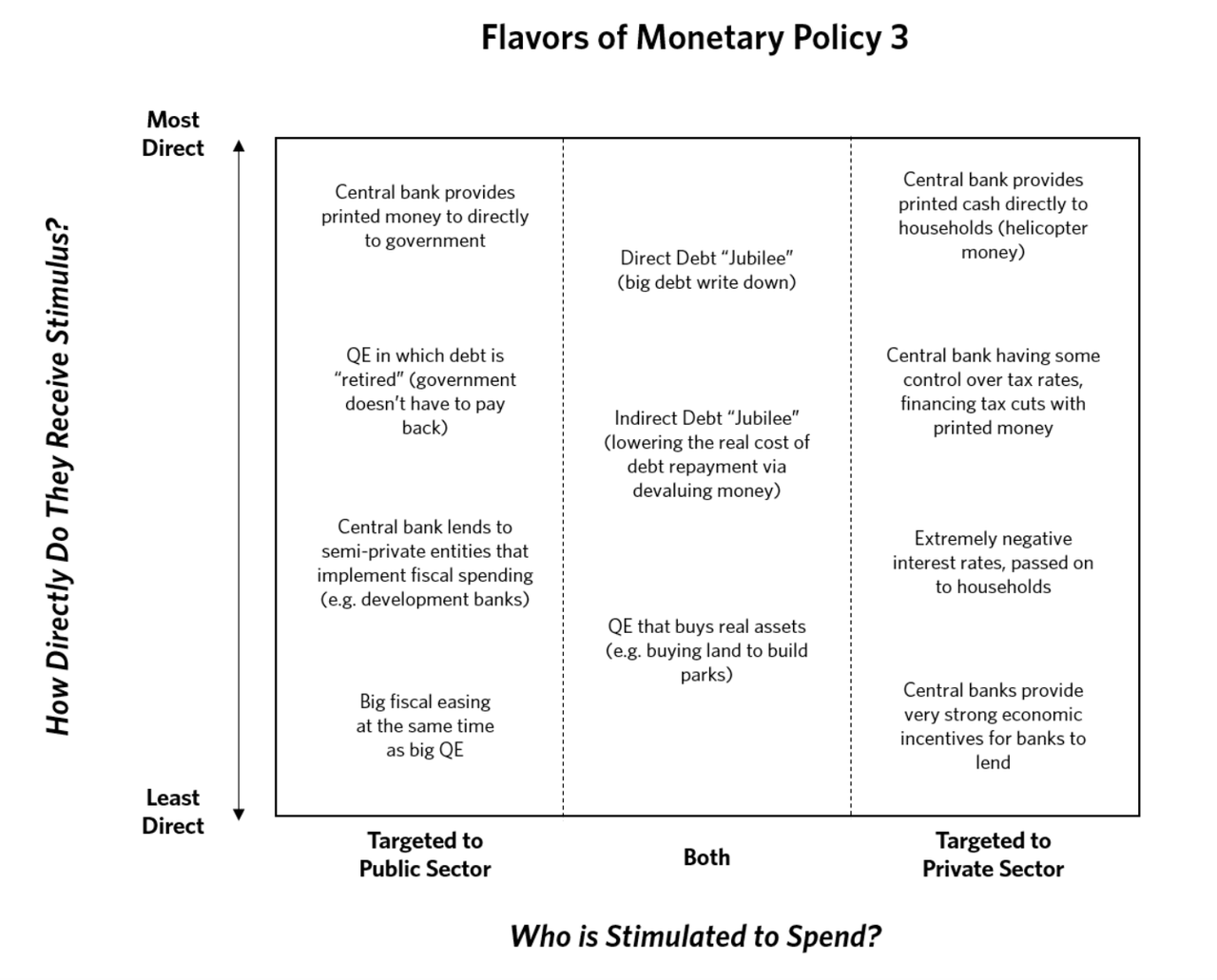

Once the public has accepted that money printing and interest-rate cuts aren’t doing enough to distribute wealth more equally (as we’ve pointed out many times, the Fed’s unprecedented post-crisis easing has been the primary driver in the expansion of economic inequality that Dalio finds so troubling), policy makers will be forced to accept “monetary policy 3” – or MMT.

To me the most important engineering puzzle policy makers around the world have to solve for the years ahead is how to get the economic machine to produce economic well-being for most people when monetary policy does not work. I don’t mean that monetary policy won’t work at all; I mean that it won’t work hardly at all in stimulating economic prosperity in the ways that we are used to having it stimulate economic activity, which are through interest rate cuts (what I call Monetary Policy 1) and through quantitative easing (what I call Monetary Policy 2). That is because it won’t be effective in producing money and credit growth (i.e., spending power) and it won’t be effective in getting it in the hands of most people to increase their productivity and prosperity. Hence I believe we will have to go to Monetary Policy 3, which is fiscal and monetary policy coordination that is of a form that we haven’t seen before in our lifetimes but has existed in various forms in others’ lifetimes or faraway places. It is inevitable that this shift will happen because it is inevitable that central bankers will want to ease when interest rates are pinned at 0% and when quantitative easing will be ineffective in achieving the goal. I recently refreshed my prior exploration of past cases and future possibilities of such coordination, which I will share below.

In the policy prescriptions he introduced during his previous essays, Dalio recommended a closer collaboration between fiscal policy and monetary policy. Now, he’s taken that a step further and advocated placing the monetary policy reins into the hands of elected officials (one of the key tenents of MMT).

For what it’s worth, Dalio acknowledges that this could present a conflict, and that if we embrace MMT, it will need to be done in a way that limits the control of politicians to enact self-serving policies (something that, as far as we can tell, would be extremely difficult)

The big risk of this approach arises from the risks of putting the power to create and allocate money, credit, and spending in the hands of politically elected policy makers. In my opinion, for these MP3 policies to work well, the system would have to be engineered in a way that decision making would be in the hands of wise, not politically motivated, and highly skilled people. It’s difficult to imagine how the system will be built to achieve that. At the same time it is inevitable that we are headed in this direction.

Ultimately, Dalio would favor a version of MMT with automated policy prescriptions to control taxes and stimulus depending on what’s happening with the business cycle, to limit the influence of politics (effectively marrying MMT with a kind of hybrid Taylor Rule).

For anyone who is unfamiliar with MMT, Dalio created this handy chart to explain the different ‘flavors’ of the policy.

Of course, Dalio isn’t the only Wall Street luminary to come out in favor of MMT. But will he stick to his guns after the inevitable backlash? Or will he eventually change his mind like Carl Icahn? Open publish panel

- Document

- Block

Status & Visibility

VisibilityPublicPublishMay 2, 2019 2:53 pmAuthoradminBob Cecilcj earthlingMove to trash

Permalink

URL Slug

The last part of the URL. Read about permalinks(opens in a new tab)

Featured Image

Set featured image

Discussion

Allow Comments

Page Attributes

Parent Page:(no parent)X-Privacy Policy6. Western Democracy is a SCAM 11/055. How to roll out ideas here 11/05http://worldparliament-gov.org/ formal design going on right now by UN2. One world government – Origins/History of the idea ALSO THE PAST 33 FAMOUS PROPONENTS OF THIS IDEA THROUGHOUT HISTORY ARE ALL LISTED BELOW 04/051- Preamble /Overall changes/General Concepts/intro/closing ideas/total value of earth .. last update 06/19Our New Currency Birth and its value/ Worldwide pay scalesreview and rework these articles posting area4. What is real Motivation That Team Humanity can provide in all aspects of everyone’s life and work? 02/05New Currency ideas from others 01/05Revised World Constitution – needs to be revised in its entirety to fit our concept 01/05Current ideas streaming in same direction 5 articles 06/19why this has to happen 9 articles 04/053. Revised Universal Declaration of Human Rights 1 docArguments Against One World 2 articlesPlanning Page 2 articlesLifelong Education 3 articles 30/7Music doesn’t lie. If there is something to be changed in this world, then it can only happen through music. Jimmy Hendrix 11/057 work to do …. TO BE REVISED ASAP condensed version of basis of all modern economic planning 6/19Order

7) Wikipedia Co-Founder Unveils “The Declaration Of Digital Independence”

by Tyler DurdenSat, 06/29/2019 – 21:302SHARESTwitterFacebookRedditEmailPrint

Humanity has been contemptuously used by vast digital empires. Thus it is now necessary to replace these empires with decentralized networks of independent individuals, as in the first decades of the Internet. As our participation has been voluntary, no one doubts our right to take this step. But if we are to persuade as many people as possible to join together and make reformed networks possible, we should declare our reasons for wanting to replace the old.

We declare that we have unalienable digital rights, rights that define how information that we individually own may or may not be treated by others, and that among these rights are free speech, privacy, and security. Since the proprietary, centralized architecture of the Internet at present has induced most of us to abandon these rights, however reluctantly or cynically, we ought to demand a new system that respects them properly. The difficulty and divisiveness of wholesale reform means that this task is not to be undertaken lightly. For years we have approved of and even celebrated enterprise as it has profited from our communication and labor without compensation to us. But it has become abundantly clear more recently that a callous, secretive, controlling, and exploitative animus guides the centralized networks of the Internet and the corporations behind them.

The long train of abuses we have suffered makes it our right, even our duty, to replace the old networks. To show what train of abuses we have suffered at the hands of these giant corporations, let these facts be submitted to a candid world.

They have practiced in-house moderation in keeping with their executives’ notions of what will maximize profit, rather than allowing moderation to be performed more democratically and by random members of the community.

They have banned, shadow-banned, throttled, and demonetized both users and content based on political considerations, exercising their enormous corporate power to influence elections globally.

They have adopted algorithms for user feeds that highlight the most controversial content, making civic discussion more emotional and irrational and making it possible for foreign powers to exercise an unmerited influence on elections globally.

They have required agreement to terms of service that are impossible for ordinary users to understand, and which are objectionably vague in ways that permit them to legally defend their exploitative practices.

They have marketed private data to advertisers in ways that no one would specifically assent to.

They have failed to provide clear ways to opt out of such marketing schemes.

They have subjected users to such terms and surveillance even when users pay them for products and services.

They have data-mined user content and behavior in sophisticated and disturbing ways, learning sometimes more about their users than their users know about themselves; they have profited from this hidden but personal information.

They have avoided using strong, end-to-end encryption when users have a right to expect total privacy, in order to retain access to user data.

They have amassed stunning quantities of user data while failing to follow sound information security practices, such as encryption; they have inadvertently or deliberately opened that data to both illegal attacks and government surveillance.

They have unfairly blocked accounts, posts, and means of funding on political or religious grounds, preferring the loyalty of some users over others.

They have sometimes been too ready to cooperate with despotic governments that both control information and surveil their people.

They have failed to provide adequate and desirable options that users may use to guide their own experience of their services, preferring to manipulate users for profit.

They have failed to provide users adequate tools for searching their own content, forcing users rather to employ interfaces insultingly inadequate for the purpose.

They have exploited users and volunteers who freely contribute data to their sites, by making such data available to others only via paid application program interfaces and privacy-violating terms of service, failing to make such freely-contributed data free and open source, and disallowing users to anonymize their data and opt out easily.

They have failed to provide adequate tools, and sometimes any tools, to export user data in a common data standard.

They have created artificial silos for their own profit; they have failed to provide means to incorporate similar content, served from elsewhere, as part of their interface, forcing users to stay within their networks and cutting them off from family, friends, and associates who use other networks.

They have profited from the content and activity of users, often without sharing any of these profits with the users.

They have treated users arrogantly as a fungible resource to be exploited and controlled rather than being treated respectfully, as free, independent, and diverse partners.

We have begged and pleaded, complained, and resorted to the law. The executives of the corporations must be familiar with these common complaints; but they acknowledge them publicly only rarely and grudgingly. The ill treatment continues, showing that most of such executives are not fit stewards of the public trust.

The most reliable guarantee of our privacy, security, and free speech is not in the form of any enterprise, organization, or government, but instead in the free agreement among free individuals to use common standards and protocols. The vast power wielded by social networks of the early 21st century, putting our digital rights in serious jeopardy, demonstrates that we must engineer new—but old-fashioned—decentralized networks that make such clearly dangerous concentrations of power impossible.

Therefore, we declare our support of the following principles.

Principles of Decentralized Social Networks

- We free individuals should be able to publish our data freely, without having to answer to any corporation.

- We declare that we legally own our own data; we possess both legal and moral rights to control our own data.